We all know that life of business is very long but on the end of every financial year, accountant makes final accounts. When next financial year is started, accountant writes one journal entry in the beginning of every financial year in which he shows all the opening balance of assets and all the liabilities include capital. Then that journal entry is called opening journal entry. Because all assets have debit balance, so these are debited in opening journal entry and all liabilities have credit balance, so these are credited in opening journal entry.

It is based on accounting equation which have we can show following way.

Assets ( debit ) = liabilities ( Credit ) + capital ( Credit )

Opening journal Entry

Assets Account (opening balance) Dr.

Liabilities account (opening balance Cr.

Capital account Cr.

If all assets are more than all liabilities, its excess will be the value of capital which is showed credit side in the opening journal entry. If liabilities are more than the value of all assets, then this excess will be goodwill and it will be debited in opening journal entry. Typically, different of assets and liability will be positive and excess value of assets are showed as capital in the credit of journal entry.

How to get data for opening journal entry?

Its answer is very simple. Just see the balance sheet of previous year and make list of all assets one side and all liabilities in other side and then this will be based for creating opening journal entry. See example

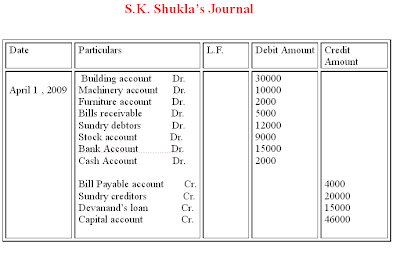

On 31st march 2009 , S.K. shukla’s assets and liabilities stood as under :-

Assets

Building Rs. 30000, machinery Rs. 10000 , furniture Rs. 2000 , bill receivable Rs. 5000 , sundry debtors Rs. 12000 , stock Rs. 9000 , cash at bank Rs. 15000 , cash in hand Rs. 2000

Liabilities

Bill payable Rs. 4000, dev anand’s loan Rs. 15000, sundry creditors Rs. 20000

Make an opening journal entry on Ist April 2009

Before passing the opening journal entry, it is necessary to find out the amount of capital.

Capital = assets – liabilities

Total assets = 85000

Less total liabilities = 39000

Capital = 46000

Benefits for passing opening journal entry

It is based on accounting equation which have we can show following way.

Assets ( debit ) = liabilities ( Credit ) + capital ( Credit )

Opening journal Entry

Assets Account (opening balance) Dr.

Liabilities account (opening balance Cr.

Capital account Cr.

If all assets are more than all liabilities, its excess will be the value of capital which is showed credit side in the opening journal entry. If liabilities are more than the value of all assets, then this excess will be goodwill and it will be debited in opening journal entry. Typically, different of assets and liability will be positive and excess value of assets are showed as capital in the credit of journal entry.

How to get data for opening journal entry?

Its answer is very simple. Just see the balance sheet of previous year and make list of all assets one side and all liabilities in other side and then this will be based for creating opening journal entry. See example

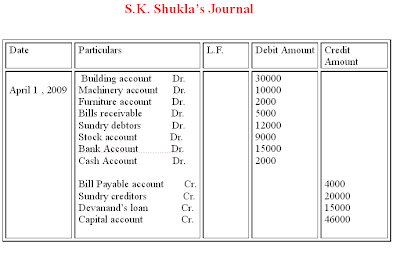

On 31st march 2009 , S.K. shukla’s assets and liabilities stood as under :-

Assets

Building Rs. 30000, machinery Rs. 10000 , furniture Rs. 2000 , bill receivable Rs. 5000 , sundry debtors Rs. 12000 , stock Rs. 9000 , cash at bank Rs. 15000 , cash in hand Rs. 2000

Liabilities

Bill payable Rs. 4000, dev anand’s loan Rs. 15000, sundry creditors Rs. 20000

Make an opening journal entry on Ist April 2009

Before passing the opening journal entry, it is necessary to find out the amount of capital.

Capital = assets – liabilities

Total assets = 85000

Less total liabilities = 39000

Capital = 46000

Benefits for passing opening journal entry

- To activate next session of accounting

- After passing this journal entry, accountant can connect all previous record with current record. Suppose, if we want to pay Rs. 10000, but we have not passed opening journal entry, bank account show negative balance. So, by passing opening journal entry before any other journal entry, we can connect previous year Rs. 100000 balance of bank with current year account of bank .

hopeful

ReplyDeleteThanks dear

ReplyDeleteThanks a lot 😊😊

ReplyDeleteIf capital is given and then assets balance is more than capital balance then what to do

ReplyDeleteIf assets balance is more than capital and liabilities, then the balancing figure is capital reserve.

DeleteHowever if capital and liabilities balance is more than assets then the balancing figure is Goodwill.

If only capital is given but till asset is bigger so what we do

Deleteclearly explained sir. Thank you.

ReplyDeleteThanks dear

DeleteThnkyou sir best solution sir.....

ReplyDeleteIf sir owing by Hari rs. 8000 is given so it will be capital or liability or asset

ReplyDeletehow will ee post it to ledger wuth other entries

ReplyDeletehow will we put in ledger

ReplyDeleteThank a lot

ReplyDeleteThank you sir

ReplyDeletereversing phle banatay hain ya opening

ReplyDeleteWhere outstanding salaries to write

ReplyDeleteBut cash in hand should open in cash book not in journal proper

ReplyDelete